Cdo i deduct my standard deduction from sales total income

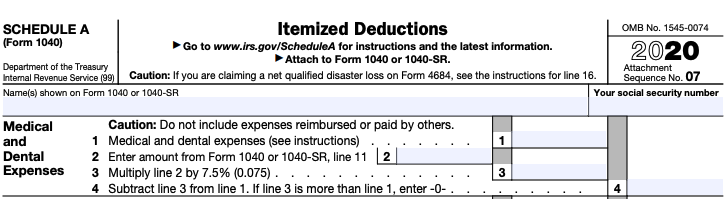

What Is the Standard Deduction sales, What Are Itemized Deductions Definition How to Claim NerdWallet sales, Standard Deduction in Taxes and How It s Calculated sales, What Is an Itemized Deduction sales, Itemized Deduction Definition TaxEDU Glossary sales, What is Standard Deduction Amount Chapter 5 Income from Salary Ded sales, Standard Deduction vs. Itemized Deduction Which Should I Ch Ramsey sales, All About Schedule A Form 1040 or 1040 SR Itemized Deductions sales, Standard vs. Itemized Deduction Calculator Which Should You Take sales, Standard Deduction or Itemized Which is better for YOU in 2018 sales, What Is a Tax Deduction Ramsey sales, Can I Take the Standard Deduction and Deduct Business Expenses sales, What is the standard deduction in income tax This year s budget sales, Small Business Expenses Tax Deductions 2023 QuickBooks sales, Itemize deductions sales, Standard deduction amounts for 2021 tax returns Don t Mess With sales, Tax Deduction Definition Standard or Itemized sales, Solved Please show me how to calculate STANDARD DEDUCTIONS Chegg sales, The Rules for Claiming a Property Tax Deduction sales, Standard Deduction vs. Itemized Deduction Which Should I Ch Ramsey sales, IRS Schedule A walkthrough Itemized Deductions YouTube sales, How to calculate standard deduction in Income Tax Act Scripbox sales, Standard Deduction What Is It vs Itemized Example sales, What Is Schedule A H R Block sales, How to calculate standard deduction in Income Tax Act Scripbox sales, Solved Attempts Keep the Highest 6 3. Choosing the Chegg sales, IRS ups standard deductions tax brackets due to inflation KARK sales, IRS Releases 2021 Tax Rates Standard Deduction Amounts And More sales, Deductions Allowed Under the New Income Tax Regime Paisabazaar sales, Standard Deduction for Salaried Individuals in New and Old Tax Regime sales, Standard Deduction What is Standard Deduction for Salaried sales, How do federal income tax rates work Tax Policy Center sales, Federal implications of passthrough entity tax elections sales, Examples of Itemized Deductions sales, How To Calculate Your Federal Taxes By Hand PaycheckCity sales, Standard vs Itemized Deductions TIME Stamped sales, What are itemized deductions and who claims them Tax Policy Center sales, Who Should Itemize Deductions Under New Tax Plan SmartAsset sales, Taxable Income What It Is What Counts and How to Calculate sales, IRS raises income threshold and standard deduction for all tax brackets sales.

- cdo i deduct my standard deduction from total income

- certainly i could see adult swim totally translating it

- cf ruffer total return i acc

- cf ruffer total return i inc

- change my total in excel when i group

- chaos total war i or ii

- cher i totally paused

- chase total business checking can i use code online

- chie but me i totally lose it

- chords dude i totally miss you

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)