If total deduction was 33000 sales for 2017 should i itemize

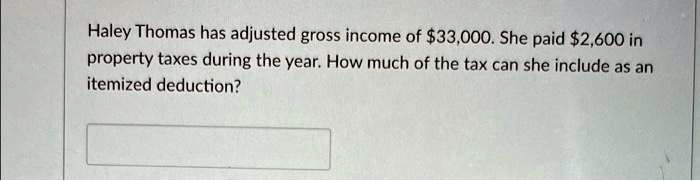

What are itemized deductions and who claims them Tax Policy Center sales, Standard vs. Itemized Deduction Calculator Which Should You Take sales, How Middle Class and Working Families Could Lose Under the Trump sales, Bunching charitable contributions Schwab Charitable Donor sales, How Did the Trump Tax Bill Affect Itemized Deductions 2021 sales, Solved Problem 10 43 LO. 2 3 4 5 6 7 8 Linda who Chegg sales, What are itemized deductions and who claims them Tax Policy Center sales, SOLVED Haley Thomas has an adjusted gross income of 33 000. She sales, SOLVED Leslie and Jason who are married paid the following sales, What s a Donor Advised Fund Wiser Wealth Management sales, 2017 Tax Guide Deductions And Audit Risk sales, Who Should Itemize Deductions Under New Tax Plan SmartAsset sales, What are itemized deductions and who claims them Tax Policy Center sales, SOLVED Haley Thomas has an adjusted gross income of 33 000. She sales, Bunching charitable contributions Schwab Charitable Donor sales, Tax Credit vs. Tax Deduction What s the Difference Guide sales, SOLVED Haley Thomas has an adjusted gross income of 33 000. She sales, Medical and dental expenses sales, Number of highest earning Canadians paying no income tax is sales, How to File a Federal Income Tax Return Study sales, Income Tax Rebate U s. 87A For A.Y. 2017 18 F.Y.2016 17 sales, support except for her 527 monthly Social Security Chegg sales, SOLVED Linda who files as a single taxpayer had an AGI of sales, This Is How Much Your Deductions Need to Add Up To Before It Makes sales, Prime Capital Funding Financing Highlights sales, Standard vs. Itemized Deduction Calculator Which Should You Take sales, Test bank for concepts in federal taxation 2017 24th edition by sales, Acc 555 week 11 final exam strayer new PDF sales, Canadian Tax Principles 2016 2017 Edition Volume I and Volume II sales, Solution Manual for Pearsons Federal Taxation 2017 Comprehensive sales, Pearsons Federal Taxation 2018 Individuals 31st Edition Rupert sales, 1040 2023 Internal Revenue Service sales, Bunching Itemized Tax Deductions How It Can Save You Money sales, Solution manual for south western federal taxation 2017 sales, How to Calculate Net Income 12 Steps with Pictures wikiHow sales, How to Calculate Net Income 12 Steps with Pictures wikiHow sales, Deductions Standard Deduction vs Itemized Deductions ppt download sales, Business Mileage Deduction How to Calculate for Taxes sales, 3.11.15 Return of Partnership Income Internal Revenue Service sales, How to Calculate Net Income 12 Steps with Pictures wikiHow sales.

- if total deduction was 33000 for 2017 should i itemize

- if total sales i popularmax popularmax totalsales i popularproduct i

- if total taxes 2k do i.get it all back

- if you dont trust me i totally understand

- im having severe sweating i had a total hysterectomy

- im 54 female totally gray should i color

- im totally chill or i will be someday

- im totally kidding i love lady parts

- images of signs saying i totally agree

- imagine i'm a total idiot

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

.png)